Posted On:

Role of Salesforce® in the Banking Industry Part- 1

Traditional banking was never easy.Right from the chaos at the cash counter to slow procedure of banking approval task- we were always skeptical about bank related work. And now with the changing era of technology, where cloud banking has taken a toll, do you think traditional banking will be able to compete?

This isn’t the first time that we are hearing issues related to traditional banking. In fact, the era of constant change has widened the banking sector gap between the customers and the bankers. Talking about the same on a general level ‘how cloud banking has changed the face of banking’. Do you prefer online transaction or standing in the queue for hours? How do you generate your atm pin? How do you get your cards blocked or unblocked? How do you apply for a loan? And an endless possibility that favors cloud banking has increased the threat rate for the traditional banking sector. If you may ask why? Here is a list of problems that pulls back the traditional banking sector along with some calculative solutions for the same. Keep reading to end your banking worries here!

Financial Crisis at its Peak

The profitability of the banking sector has always made to the headlines. But in the real world scenario, it is different. Despite making up to the headlines, the reality holds untold truth. Banking sector is not making enough return on investment due to the increasing adoption of technology. The traditional sector is lagging behind, resulting in a decreased return on investment, return on equity and the shareholder requirements. In fact, investors tend to invest more in cloud technology than spending bucks into old and lengthy procedures of traditional banking.

Competitive Threat from the FinTech Companies (Financial technology)

Paypal, Amazon pay, Samsung pay and a number of such names has changed the way we perceive banking. No one ever thought banking can get summed up in our smartphones where you don’t even have to carry your cards. FinTech Companies made this dream come true. Talking about the latest scenario, almost everyone has adopted these technologies. As it goes without saying, the increasing pressure from the fintech industry has shaken up the entire banking industry. The key reason being the following

- Traditional banking lags basic technological amenities

- They aren’t prepared enough to adjust to the situation

- The traditional culture is pulling them back

- They lag basic customer experience

- Increasing Pressure from cloud banking

Failed Consumer Experience

In the current era of technology where everything is about customer experience, banking sector stands nowhere when it comes to keeping your customers satisfied. Right from Paypal to Amazon, one key factor for making or breaking the industries reputation is ‘how happy is your client/customer’. Now when we talk about the banking sector, what do you think can be the level of satisfaction that it can provide to its customers? Considering it in terms of technology, right where cloud banking can already serve everything on a silver platter, traditional banking lags basic fulfillment. Having failed to please your customers will directly result in the downfall of the organization/Industry. How do you think the banking sector can cope up with the issue when they lack the simplest of amenities?

No worries, because every problem comes with a set of solution, and we have found your solution this time!

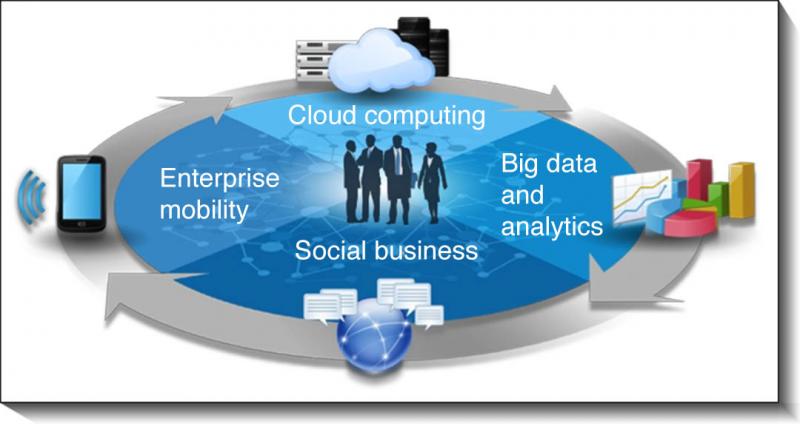

Salesforce® Architecture in Banking Implementation

As we say, a great CRM can help companies to outshine their competition at ease, close deals and provide excellent customer services across all industry verticals. CRM solutions are lucrative that leverages great benefits.

Bringing to you some of the major benefits that Salesforce® (CRM solution) can bring to the banks and to the customers.

- Salesforce® as a CRM solution can help the banks in managing their customers better

- Banks will be able to understand the needs of the customers in detail

- Better technological implementation

- New customer-centric business model can be adopted

- Better digitalized experience

- Increased marketing effects

- Better Rapport of the industry vertical

- Rate of customer retention will increase

- Increase in the rate of customer loyalty

- Better customer experience throughout the banking procedure

- An effective and efficient communication channel

- Two-way interaction

- Simplified data tracking amongst different departments of the bank

- Customizing each customers journey

- Increased rate of productivity

- Delivering a Digital Engagement

Salesforce® enables the bank to deliver digitally revolutionized banking experience (in sync with customer expectation). With the implementation of Salesforce®, banks can experience an altogether new and digitalized banking. Right from simple on-boarding to real-time service delivery, Salesforce® can embark upon the financial journey and digital transformation that is available both online and offline (just like the mobile banking experience).

Enhanced Communication Channel

The most crucial factor in the banking industry is transactions and interaction. Considering these points, Salesforce® effectively tracks the first and last interactions with the customers. This record helps the bankers to quickly pick up on a conversation and deliver the needful to the customers. There are other informations that Salesforce® effectively conveys to the bankers such as household relationships, extended networks, and financial life goals. Hence Salesforce® is personalizing the customer journey through effective communication and better understanding and helping each customer in achieving a new milestone of banking experience.

What’s Your Final Thought?

CRM or the Salesforce® solutions are no more limited to the retail business world, they can now be easily implemented for any entity or industry type. Talking about business banking, it is now a customer-driven world. Banks that can understand the needs of their customers well, serves a greater chance of success. Adopting Salesforce ® as a CRM solution for banks is the best that banks can do for both the bankers and the customers.

And the words are yet not over. We will unveil few more banking sector issues along with its pro solutions right in the next blog. Till then, keep reading HTP and top your sales funnel like a pro.

Comments